As more and more people embrace blockchain technology and adopt digital currencies into their financial lives, alarmists have come out swinging with yet another red flag: that mining cryptocurrency is destroying the environment.

Here is the argument: crypto mining is energy-intensive, contributes to electronic waste, and entices many countries to burn more fossil fuels to generate electricity for crypto mining operations.

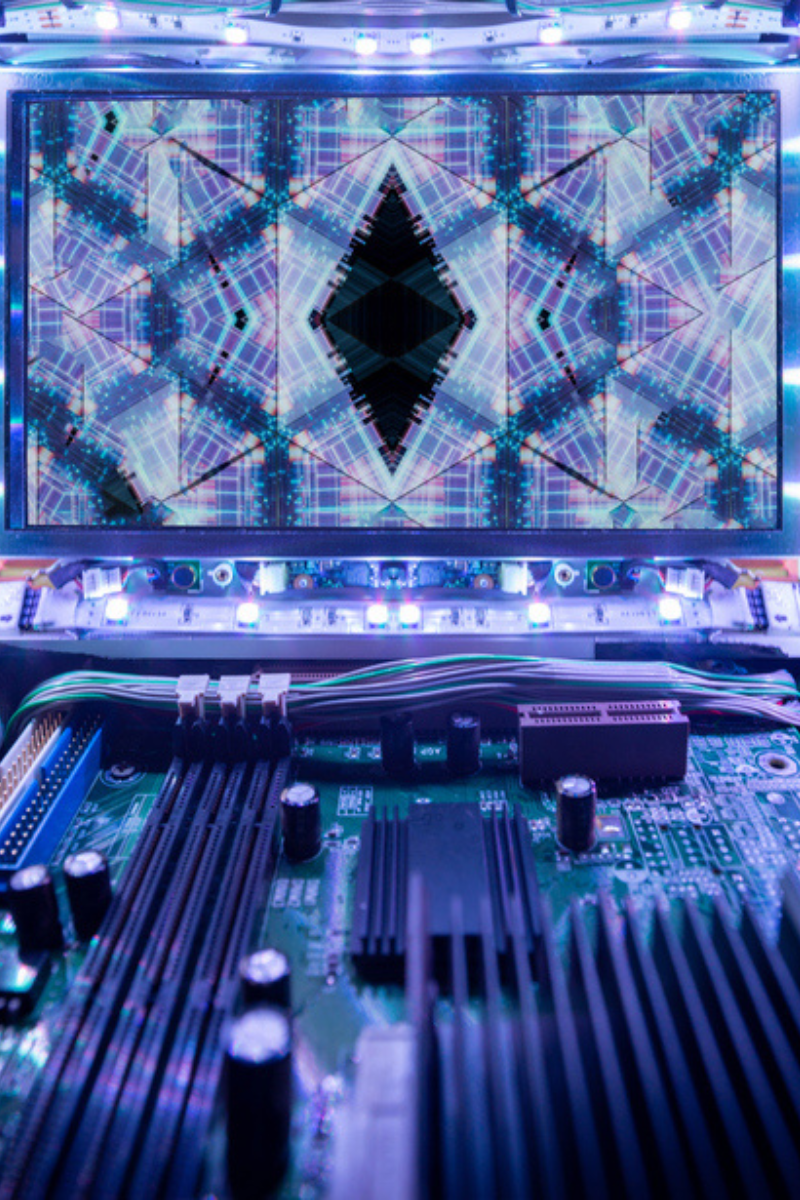

For example, Bitcoin runs on a proof-of-work (PoW) system, which is dependent upon individuals having to figure out equations to excavate new coins and add new blocks of information to a digital currency’s blockchain. This underlying technology keeps the whole system humming along. The procedure’s complexity was tailored explicitly to ward off cyberattacks and centralized control, although critics continue to lament the uptick in energy use.

Here is the reality: there are no singular means of calculating the energy used for a currency like Bitcoin. Carbon emissions are not equal to energy consumption. The amount of energy consumed by the Bitcoin network can be determined relatively easily; however, its carbon footprint is far more difficult to assess.

In May, the Bitcoin Mining Council – which includes heavyweights such as Jack Dorsey and Michael Saylor – offered a blistering response to a group of House Democrats such as Alexandria Ocasio-Cortez, Rashida Tlaib and Brad Sherman, who sent a letter to the U.S. Environmental Protection Agency (EPA) warning the agency about the “pollution and emissions” of crypto mining and requesting more taxpayer dollars to launch a probe into the “negative consequences.”

Other concerns raised in the letter included electronic waste from hardware replacement, greenhouse gas emissions, and the reopening of former gas and coal plants.

“We have authored a response to clear up the confusion, correct inaccuracies, and educate the public,” tweeted Saylor.

The response letter directly responds to seven points made in the lawmakers’ letter, contending that miners “utilize electricity like any other data center, and mining itself does not create emissions” and thus should not be treated any differently from other power-using computational processes. Moreover, the council letter highlighted the Representatives’ open admission that the cited research primarily cited was based on false or biased research drawing inaccurate conclusions.

“The ‘per-transaction’ energy cost analysis is a deeply flawed way to reason about Bitcoin, since projecting future energy growth is not a function of transaction count, but instead of value of Bitcoin issuance (which is a function of price and supply growth), together with the fees users are willing to pay to transact,” the Council states in its lengthy rebuttal. “Unfortunately, the Letter is premised on several misperceptions about Bitcoin and digital asset mining that have previously been debunked or conflate Bitcoin mining with other industries.”

Some specific examples refuting the Democrats’ assertions include:

Lawmaker Signatories: “We have serious concerns regarding reports that bitcoin mining facilities across the country are polluting communities and are having an outsized contribution to greenhouse gas emissions.”

Council Response: This is deeply misleading: there are no pollutants, including CO2, released by digital asset mining. Bitcoin miners have no emissions whatsoever. Associated emissions are a function of electricity generation, which is a consequence of policy choices and economic realities shaping the nature of the electrical grid. Digital asset miners simply buy electricity that is made available to them on the open market, just the same as any industrial buyer.

Lawmaker Signatories: “A single Bitcoin transaction could power the average U.S. household for a month.”

Council Response: This is patently and provably false. Bitcoin transactions do not carry “energy payloads.” Bitcoin transactions cannot be “redeemed” for energy. Broadcasting a transaction requires no more energy than a tweet or a Google search. Bitcoin miners collect revenue based on the issuance of Bitcoin (currently 99% of their revenue mix) and fees associated with individual transactions (which can involve thousands of distinct, separate transfers). Causally speaking, the high price of Bitcoin combined with its yearly new issuance (328k BTC this year) induces miners to consume energy.

Lawmaker Signatories: “Less energy-intensive cryptocurrency mining technologies, such as “Proof-of-Stake” (PoS), are available and have 99.99 percent lower energy demands than PoW to validate transactions.”

Council Response: This is, once again, misleading. Proof of Stake is not a ‘mining technology’; it is a technique to determine authority over a distributed ledger, but it does not achieve decentralized distribution.

Moreover, it has a much more limited track record, is controlled by founders, has single points of failure, and it remains dubious as to whether Proof of Stake can effectively govern a global, apolitical monetary system in a manner like Proof of Work.

Given that Proof of Stake and Proof of Work are qualitatively different, it’s misleading to refer to Proof of Stake as a more ‘efficient’ form of Proof of Work since it does not achieve the same thing. For example, a bicycle uses less energy than a plane, but it achieves something different and so cannot be considered more efficient. Similarly, Proof of Stake only pertains to maintaining a nominally decentralized consensus over the state of a ledger (although it remains to be seen whether Proof of Stake systems can remain meaningfully decentralized).

So where is all this headed?

Many new digital currencies are turning to the “proof of stake” (PoS) concept. This method relies on validators to “stake” their currencies in exchange for an opportunity to authenticate new transactions and update the blockchain, thus rewarding long-term investors. According to Investopedia, “a validator is picked based on how much currency they have staked and how long it has been staked for. Once the block is verified, other validators must review and accept the data before it’s added to the Blockchain. Then, everyone who participated in validating the block is rewarded with coins.”

For one, China has implemented significant bans on mining – almost comically citing the environmental repercussions – and there are concerns other countries could follow suit based on an elusive consensus.

The hoopla surrounding the environmental argument prompted U.S. Congress to announce an investigation into the environmental impact and energy demands in January this year.

Nevertheless, it is critical to remember that not all blockchain podiums and cryptocurrencies are equivalent in their processing power needs.

Late last year, Sen. Elizabeth Warren (D-MA) also sent an official letter to prominent Bitcoin miner Greenridge Generation requesting data relating to the ecological imprint, sparking a bevy of broader concerns and inquiries from fellow lawmakers and political figures.

In June, New York legislators passed a landmark environmental measure intended to curb cryptocurrency mining operations in the state, the first of its kind in the country.

The bill backed by climate change activists seeks to establish a two-year freeze on new and renewed air permits for fossil fuel power plants used for “proof-of-work” mining. However, crypto enthusiasts contend that not only are the claims put forward wrong, but they target one industry without acknowledging the myriad of other ways fossil fuels are used in the state.

Furthermore, opponents vow the new law will hurt economic development in the country’s financial capital and only prompt miners to take operations to other states with more friendly regulatory frameworks.

Indeed, the moratorium will likely zap New York out of the growing list of states seeking to topple California’s status as a hub for tech innovation. In recent years, the rural upstate region of New York has become a leading hub for crypto mining with many companies establishing bases where relatively inexpensive hydropower is readily available, and land is affordable. Some have even transformed rarely used fossil plants into crypto mining operations.

However, many worry the results of the recent showdown in Albany could determine the future of mining in the country should other states adopt the same approach.

It also runs counter to the approach adopted by New York City Mayor Eric Adams, known for his ardent backing of the crypto movement. He is now calling on the Governor to veto the legislation. Other prominent figures, including Sen. Todd Kaminsky (D-Nassau), who chairs the Environmental Conservation Committee, quarrel that locking New York out of the crypto industry will be akin to a “catastrophe.”

The moratorium is a concern for cryptocurrency companies that don’t own or contract with fossil fuel plants since the law allows other industries to run on fossil fuels while shutting out the crypto industry. Nonetheless, initiatives are underway in the fight against climate concerns. For one, a report issued earlier this year from the United Nations Environment Program (UNEP) and the Social Alpha Foundation (SAF) explores how the technology “can accelerate the transition to clean energy and help combat climate change in developing countries.”

“The world needs to almost halve emissions over the next eight years to stay on track for a 1.5°C world while at the same time expanding access to energy to bring hundreds of millions of people onto the grid,” said Mark Radka, Chief of UNEP’s Energy and Climate Branch, referring to data from UNEP’s Emissions Gap Report 2021. “Blockchain technology can play a part by making possible more accurate load monitoring, generation and distribution in the grid through efficient use of data.”

What many lawmakers also miss is that blockchain systems can accelerate the deployment of renewable energy in developing countries and assist states in moving away from unsustainable electricity subsidies, according to the report. According to the UNEP/SAF report, blockchain’s distributed ledger technology can, “provide improvements by enabling renewable energy project developers, investors, and purchasers to collaborate on a common platform with established international standards for due diligence and compliance.”

And like all industries reliant upon past energy sources, crypto mining has undoubtedly made significant strides into the “green mining” realm. Data released by Cambridge University last year demonstrates that Bitcoin mining has drastically improved in recent years, improving its carbon footprint dramatically.

Much of the older, inefficient computing gear has been taken offline and replaced by faster and less laborious systems. A slew of major tech companies are spending tens of millions on building crypto mines that run on renewable energy sources.

Elon Musk and other crypto CEOs have tasked the Bitcoin Mining Council with spearheading energy transparency, making blockchain entirely powered by renewable energy by the end of 2025, and to achieve zero emissions within the arena by 2040. This is set to be accomplished via the decarbonization of blockchain technology by shifting to energy-efficient algorithms and requiring PoW systems to be located in proximity to abundant renewable energy sources.

Additionally, the likes of the famed Ethereum network are moving to PoS algorithms, although the kinks in ensuring complete decentralization are still being worked out. Still, tech innovators are developing a range of mining methods such as proof of elapsed time, proof of burn, proof of history, and proof of capacity.

It is only logical that a strong focus on the sustainability side of the crypto mining maze – and the quest for even greener solutions – will lead the way as the industry continues its expansion leaving politicians largely on the sidelines to react to the everchanging blockchain technology landscape.